Translation Business Reshuffle

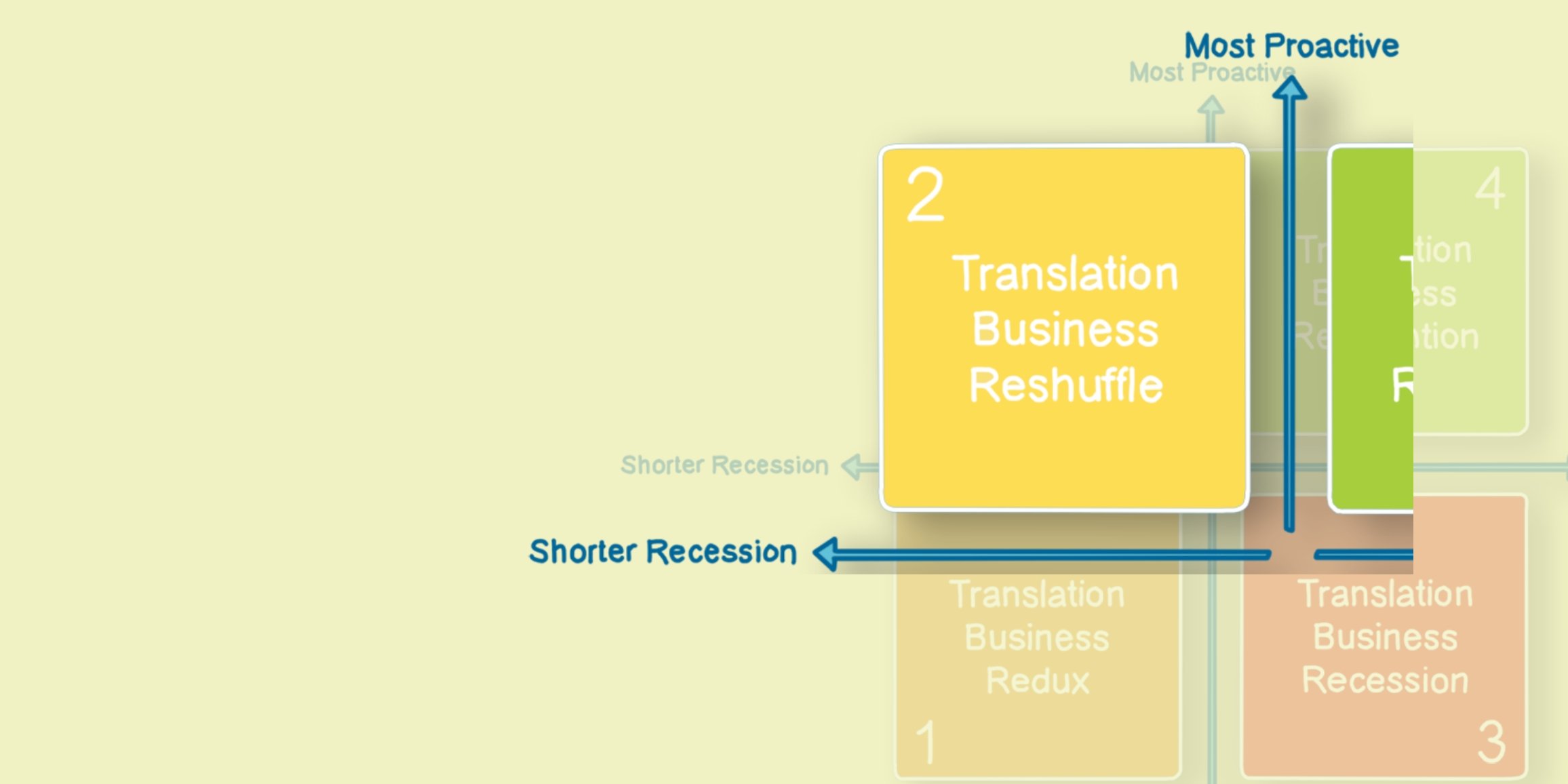

Two hundred people responded to our survey about the state of the translation industry in the summer of 2021. In this series, we will sequentially analyze each post-corona scenario: Redux, Reshuffle, Recession, Reinvention.

The 2020 corona crisis has left its scars on the translation industry even though the recession didn’t last that long. We saw quite a few agencies closing shop. A few of the larger investors took advantage of the crisis and absorbed more businesses, leading to further consolidation at both global and regional levels. Thousands of language workers lost their regular jobs. This was a sobering experience, but there were no fundamental changes. The virus simply reshuffled the existing pack..jpg)

That was our scenario, and of the two hundred people who responded to our survey about the possible state of the translation industry in the summer of 2021, a sizeable 30.5% reckon that the industry will reshuffle. Here’s what this cohort anticipates.

Trending... as Usual

Pessimists don’t start translation businesses! This COVID-19 crisis may not create daring new trends or revolutionize the industry; but it is very likely to accelerate existing trends. As the quadrant that wagers on a shortish impact of the pandemic with a proactive mindset, our rational Reshufflers predict that they can draw on their wisdom in a globally positive way.

OK, the crisis has certainly prompted a sharp rise in the need for remote instead of on-site interpreting, causing pain and some panic. Yet this movement was already underway before the crisis, and WFH (working from home) has in any case been an industry tradition for years.

E-commerce, meanwhile, is booming under confinement, cranking up demand for further translation. Likewise, pharma, medical research news, and life science content generally will almost inevitably increase demand. And more companies in multiple sectors are likely to overhaul or expand their websites and digital presence in an effort to boost visibility in a more competitive digital environment. This too should mean more localization and multilingual communication, but would not require radical change across the industry.

In the same way, the current collapse of demand in the hospitality, travel and related local bricks & mortar services is more like a mechanical reaction to a sudden crisis than an evolution in the market pointing to some fundamental change. As Paul Mangell (Alpha CRC) puts it: “Less travel means more digital content sharing, which means more required translation for content The shift is therefore a ‘reshuffle of content over product’.” And in due course, hospitality & Co. will eventually be back

This in no way alleviates the pain when business is inevitably lost in varying orders of magnitude, but there is clarity about the reasons for this, as they are external to the sector. The reshuffle scenario, therefore, is a vote for rational decision-making: business will continue despite various types of external interruptions, because the fundamentals are still relatively strong: The economy will likely remain globalized, so content will continue to be translated.

Shake-outs Si, Disruption No

Innovation will come from outside the industry. As Jean-Noel Bert of AIT Traduction, France, puts it, “there will be opposition between businesses that want to maintain the old model and those who want to change it. The result will be somewhere in the middle ground between those two opposing forces.”

For Renato Beninatto (Nimzdi) too, this crisis will not lead to industry disruption. The industry’s innate tendency towards consolidation will probably be confirmed, as middle-sized companies start looking for smaller companies, or mergers begin to profile at the top. This might lead to external investments being withdrawn during a reshuffle sequence. But not the kind of stimuli being given to startups now emerging in anything from home automation to finance management.

However, many of those who voted for the Reshuffle option say they hesitated between that and Reinvention (where the emphasis tends to be on change through automation and innovation). This suggests that the forces at work due to COVID-19 are not powerful enough to stimulate a tectonic shift (which would require much more radical disruption), but could shake out some existing “weaknesses.”

One is the potential opportunity for M&As as large companies eye up competitors; another point to change in the technology component. As Renato says, the industry has an unsustainable 600 “tech” companies at work, and suggests there will be a move towards transforming tech into managed services or outsourcing their management to an organization. During the crisis, it may be wise to think about replacing those decade-old legacy systems. But this is yet another rational decision.

Focus: How a Reshuffle could Impact Stakeholders

Translators and Small LSPs

A combination of cash and technology value-add (e.g. digital networking should help smaller LSPs weather the storm. Translators will inevitably suffer from any initial squeeze but overall the long tail of supply-siders see themselves as resilient and adaptable in a crisis.

Big LSPs Don’t Cry

If the reshuffle involves an increase in large companies and a certain concentration of expertise and investment in a smaller cohort, there is a risk that innovation could be threatened, or that certain services offered by smaller SLVs would be lost or rendered too expensive. On the other hand, concentration of the offering in a smaller range of LSPs could increase price pressure and inspire alternatives.

Yet LSPs have the flexibility to build new processes relatively easily to meet new technology needs or processing lines, enabling the onboarding of MT, for example, as a new service component. They must also be ready to shift their interpretation services from on- to off-site, which may require new investments.

And Buyers Expect… Value

The need for translation will never go away, but levels of business will inevitably shift, with or without a vaccine. This basically means that established vendor/buyer relations will remain resilient. But among bigger buyers, some will see the future as an opportunity to expand their market range, while others could see a danger in over-extending and therefore retract to their core markets. However, warns one respondent, the translation sector as a whole needs to reinvent the way it makes its arguments for the value it provides. A key aspect of this will be to deepen and broaden its digital global reach.

Check back with this blog next week to hear more about the perspective of those who believe we should expect a big recession in the translation industry in the summer of 2021.

Jaap van der Meer founded TAUS in 2004. He is a language industry pioneer and visionary, who started his first translation company, INK, in The Netherlands in 1980. Jaap is a regular speaker at conferences and author of many articles about technologies, translation and globalization trends.

by Dace Dzeguze

by Dace Dzeguze